Pakistan is facing a severe inflation crisis that threatens to undermine its fragile economic recovery and exacerbate social inequality and political instability. The country’s inflation rate has surged to a record high of over 12% in February 2023, driven by various factors such as energy and food prices, currency devaluation, supply chain disruptions, and COVID-related disruptions. The government has warned businesses and consumers to brace for more inflationary pressures, as the second-round effects of its policy decisions ripple through the economy.

In this article, we will examine the causes, consequences, and policy options for Pakistan’s challenge, and assess the outlook for the country’s economic performance and social welfare.

Causes of Inflation

It is a complex and multi-dimensional phenomenon that reflects the interaction of supply and demand factors, as well as structural and policy issues. In Pakistan’s case, the recent surge can be attributed to several interrelated factors:

- Energy and Fuel Prices: The government has raised the prices of electricity, gas, and petrol to reduce its fiscal deficit and meet the IMF’s loan conditions. However, these price hikes have raised the cost of production and transportation, which have been passed on to consumers in the form of higher prices for goods and services.

- Currency Depreciation: The rupee has depreciated by over 40% against the US dollar since 2017, making imports more expensive and reducing the purchasing power of the people. The recent devaluation of the rupee by the central bank has further fueled inflationary pressures, as import-dependent sectors such as food, medicines, and raw materials have become costlier.

- Supply Chain Disruptions: The COVID pandemic has disrupted global and domestic supply chains, causing shortages and price hikes for various essential and non-essential items. The closure of borders, ports, and factories has constrained the availability and distribution of goods, while the surge in demand for certain items (e.g., healthcare, home appliances) has led to hoarding and profiteering.

- Demand-Supply Imbalance: Pakistan’s economy is still recovering from the pandemic-induced recession, and the demand for goods and services has been outstripping the supply, leading to higher prices. The government’s expansionary fiscal and monetary policies have also boosted the demand for credit and liquidity, which has fueled inflationary expectations and speculative activities.

Consequences of Inflation

It has far-reaching and negative consequences for the economy and society, especially for the poor and vulnerable segments. Some of the main consequences are:

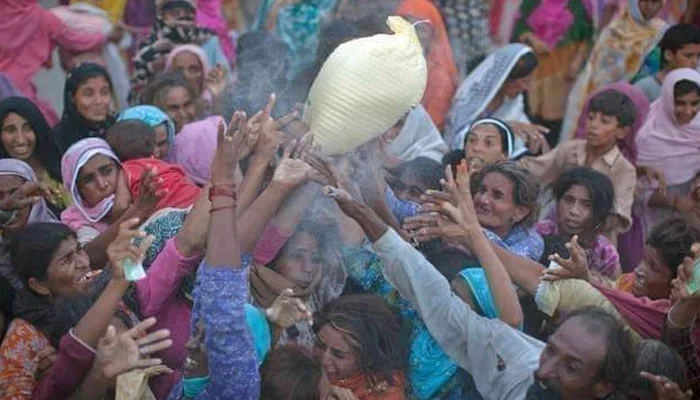

- Reduced Purchasing Power: Inflation erodes the purchasing power of the people, especially those who rely on fixed incomes, such as pensioners, low-wage workers, and small savers. The higher prices of goods and services reduce their real income and standard of living, and force them to cut back on essential expenses such as food, healthcare, and education.

- Increased Poverty and Inequality: Exacerbates poverty and inequality by reducing the value of assets and savings of the poor, and widening the income and wealth gaps between the rich and the poor. The higher prices of food and fuel also hit the poor hardest, as they spend a larger share of their income on these items.

- Slower Economic Growth: It reduces the confidence of investors, lenders, and consumers, and increases the uncertainty and risk of doing business. The higher cost of borrowing and production also reduces the profitability and competitiveness of firms, and leads to lower investment, employment, and output.

- Fiscal and External Pressures: It creates fiscal and external pressures on the government and the central bank, as they have to finance the higher subsidies, wages, and debt servicing costs, and maintain the stability.

- According to the State Bank of Pakistan, the country’s inflation rate reached 12.3% in February 2023, the highest level since November 2011. The inflation rate was 9.1% in February 2022, indicating a sharp rise in prices over the past year.

- Food inflation, which accounts for a significant portion of the consumer price index, increased by 16.4% year-on-year in February 2023, compared to 12.9% in January 2023. Within food, the prices of vegetables, fruits, meat, and poultry rose by 18.8%, 24.7%, 19.3%, and 19.8%, respectively.

- Non-food inflation, which includes housing, transport, healthcare, education, and other services, increased by 10.7% year-on-year in February 2023, compared to 9.1% in January 2023. Within non-food, the prices of electricity, gas, and petrol rose by 46.6%, 55.5%, and 44.5%, respectively, over the past year.

- Pakistan’s consumer price index (CPI) increased by 10.5% in the first eight months (July-February) of the current fiscal year (2022-23), compared to 5.7% in the same period of the previous fiscal year. The CPI for urban areas increased by 10.7% and for rural areas by 10.2% in the same period.

- The government has revised its target for the current fiscal year from 8.2% to 11-13%, reflecting the persistent and widespread inflationary pressures in the economy. The International Monetary Fund (IMF) has also raised its expansion forecast for Pakistan to 11.5% for 2022, up from 9.5% in its previous projection.

- Pakistan’s inflation rate is higher than that of its regional peers, such as India (4.1%), Bangladesh (6.4%), Sri Lanka (8.9%), and Nepal (10.2%), according to the latest available data from their respective central banks.

- The government has taken several measures to address it, including reducing taxes on food items, increasing subsidies on utilities for low-income households, and enhancing monitoring and enforcement of price controls. However, these measures have had limited impact so far, and more structural reforms are needed to address the root causes of it, such as energy sector reform, exchange rate stabilization, and supply chain management.