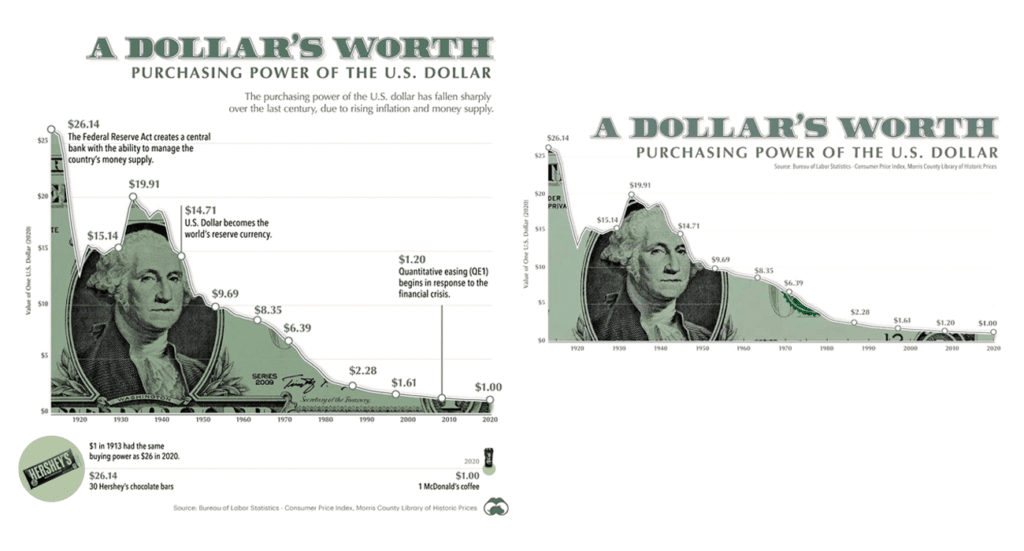

The purchasing power of the US dollar has been declining over time, causing concern among consumers, investors, and policymakers. In 1913, $1 had the same purchasing power as $26 in 2020, which means that the dollar has lost over 95% of its value in the past century. This decline in purchasing power has been caused by several factors, including the growth of the money supply, inflation, and currency devaluation.

Causes of the decline in purchasing power of the US Dollar

The primary cause of the decline in the purchasing power of the US dollar is the growth of the money supply. When the government prints more money, it increases the supply of the currency in circulation, which can lead to inflation. Inflation reduces the value because it causes prices to rise, making it more expensive to buy goods and services.

The Federal Reserve, the central bank of the United States, controls the money supply and is responsible for maintaining price stability. However, the Fed has been criticized for its monetary policy, which some argue has led to a decline in the value of the dollar.

Another factor contributing to the decline in the purchasing power of the dollar is currency devaluation. When a country devalues its currency, it makes its exports cheaper and its imports more expensive, which can boost its economy. However, it also makes its currency less valuable, reducing its purchasing power.

The US government has been accused of engaging in currency devaluation to boost its exports and reduce its trade deficit. For example, in 2019, the US accused China of manipulating its currency to make its exports cheaper and gain an unfair trade advantage.

Effects of the decline in purchasing power of the US Dollar

The decline in the purchasing power of the US dollar has several negative effects on the economy and consumers. One of the most significant effects is inflation, which reduces the value of savings and retirement accounts. When the cost of goods and services increases, consumers can buy fewer items with the same amount of money, reducing their standard of living.

Inflation also reduces the purchasing power of fixed-income earners, such as retirees and low-income families, who may struggle to keep up with rising costs. Additionally, inflation can discourage investment and lead to a decline in the value of stocks, bonds, and other assets.

The decline in the value of the dollar also has implications for international trade and the global economy. When the currency loses its purchasing power, it makes imports more expensive and exports cheaper, which can hurt domestic industries and cause a trade deficit. Additionally, a weak dollar can reduce the US’s economic influence and undermine its status as a global superpower.

Source: Bureau of Labor Statistics, Consumer Price Index, Morris Country Library of Historic Prices

Solutions to address the decline in purchasing power of the US Dollar

To address the decline in the purchasing power of the US dollar, policymakers have proposed several solutions. One approach is to reduce government spending and balance the budget, which can reduce the need for the government to print more money and inflate the currency.

Another solution is to increase interest rates, which can reduce the money supply and curb inflation. The Fed has already begun to raise interest rates in response to concerns about inflation, but this approach must be balanced against the need to support economic growth and job creation.

Explore more: Donald Trump says the US Dollar will no longer be the world standard

Additionally, some policymakers have called for a return to the gold standard, which would tie the value of the dollar to the price of gold. This approach would limit the government’s ability to print more money and inflate the currency, but it could also limit its flexibility in responding to economic shocks.

Related posts: Kenya’s President Advises Citizens to Ditch US Dollars Amid Global Currency Turmoil

The decline in the purchasing power of the US dollar is a complex issue that has far-reaching implications for the economy, consumers, and global trade. The growth of the money supply, inflation, and currency devaluation are some of the primary causes of this decline. Inflation, reduced standard of living, reduced investment, trade deficit, and reduced economic influence are some of the negative effects of this decline.

Similar articles: China invests $39 Billion in Malaysia to reduce dependency on US Dollar

To address this issue, policymakers have proposed several solutions, including reducing government spending, increasing interest rates, and returning to the gold standard. However, these solutions must be balanced against the need to support economic growth and job creation.

Read more: De-dollarization: A critical solution for developing countries

Ultimately, the decline in the purchasing power of the US dollar is a challenge that requires a comprehensive approach. By working together, policymakers, businesses, and consumers can take steps to ensure that the US dollar remains a stable and valuable currency for years to come.