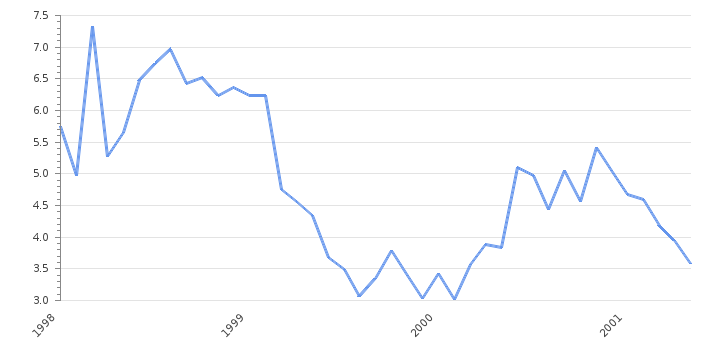

In a positive development for Pakistan’s economy, the country has witnessed a significant decrease in its weekly inflation rate. The latest figures indicate a decline of 0.42%, bringing relief to consumers and policymakers alike. This article delves into the reasons behind this decline and explores its potential implications for the country’s economic landscape.

Understanding Inflation:

Inflation is an economic phenomenon characterized by a sustained rise in the general price level of goods and services within an economy over a specific period of time. When inflation occurs, each unit of currency buys fewer goods and services, reducing the purchasing power of consumers and businesses. This can have widespread effects on the economy, including increased production costs, reduced real wages, decreased savings, and altered consumer behavior. Central banks and governments closely monitor inflation rates and strive to maintain a balance to avoid both excessive inflation, which can lead to economic instability, and deflation, which can hinder economic growth. Various factors, such as changes in supply and demand, government policies, and external shocks, contribute to fluctuations in inflation rates.

Factors Contributing to the Decrease:

Government Measures: The Pakistani government has implemented various policies to combat inflation, such as tightening monetary policy, enhancing fiscal discipline, and promoting price stability. These measures have played a role in curbing the upward trajectory of inflation. Enhancements in the supply chain have contributed to lower inflation rates. Efficient transportation, reduced logistical bottlenecks, and better coordination between producers and consumers have helped stabilize prices. Pakistan heavily relies on imported oil, and fluctuations in international oil prices can significantly impact inflation. A decrease in global oil prices has eased inflationary pressures on the country.

Implications for the Economy:

Consumer Relief: A decrease in inflation is good news for consumers, as it means their purchasing power improves. Lower prices lead to increased affordability, enabling individuals to meet their daily needs and discretionary spending with greater ease. A declining inflation rate is indicative of improved economic stability. It fosters investor confidence, as businesses can better forecast costs and plan for the future. Stable prices contribute to long-term sustainable growth and attract foreign investment.

Decline Inflation:

The decline in inflation may prompt policymakers to reassess their strategies and focus on areas requiring attention. It provides an opportunity to address underlying issues, such as structural inefficiencies, to sustain the downward trajectory of inflation .Lower inflation can positively impact other macroeconomic indicators, such as the exchange rate, interest rates, and unemployment rates. Stable prices allow for better monetary policy formulation, fostering overall economic resilience.

Future Outlook:

While the recent decrease in weekly inflation is encouraging, it is essential to monitor the trajectory in the coming months. Sustaining a low inflation rate requires ongoing efforts from the government, policymakers, and relevant stakeholders. Close attention to factors such as global commodity prices, fiscal discipline, and structural reforms will be crucial in maintaining stability and driving economic growth. Structural reforms play a crucial role in driving sustainable economic growth and maintaining low inflation.

Read More: Historic Development: Gwadar Port Begins Direct Trade Exports to China

Implementing reforms:

Implementing reforms that enhance productivity, promote competition, and attract investment can help to create a conducive environment for economic expansion. Structural reforms can include measures such as improving infrastructure, streamlining regulations, and investing in education and skills development. These reforms contribute to long-term growth and stability by increasing the economy’s capacity to produce goods and services efficiently.

Conclusion:

Pakistan’s weekly inflation rate has experienced a noteworthy decline of 0.42%, providing relief to consumers and bolstering economic stability. The government’s measures, improved supply chain, and international oil price trends have contributed to this positive development. Lower inflation benefits consumers, fosters economic stability, and opens avenues for policy adjustments and future growth. However, continued efforts are necessary to sustain this trajectory and address underlying structural inefficiencies. With careful monitoring and proactive measures, Pakistan can strive towards long-term economic prosperity.